Get the free w 4v form

Show details

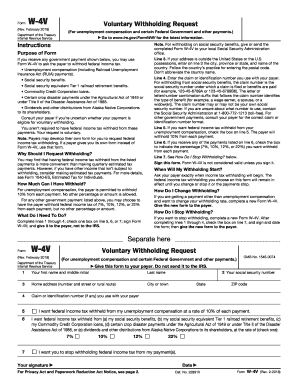

Department of the Treasury Internal Revenue Service Information about Form W-4V is at www.irs.gov/w4v. Purpose of Form Line 3. Caution DRAFT NOT FOR FILING This is an early release draft of an IRS tax form instructions or publication which the IRS is providing for your information as a courtesy. Do not file draft forms. Also do not rely on draft instructions and publications for filing. We generally do not release drafts of forms until we believe we have incorporated all changes. However in...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form w 4v

Edit your w4 v form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs form w 4v printable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing w4v online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit irs form w 4v. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out w4v form

How to fill out "Can you change social"?

01

Start by carefully reading the form and following the instructions provided.

02

Provide accurate and up-to-date information in all the required fields.

03

Double-check your answers for any errors or omissions before submitting the form.

Who needs "Can you change social"?

01

Individuals who have experienced a change in their social security number due to various reasons such as identity theft, marriage, or immigration-related issues.

02

People who want to update their social security information to reflect a new name or other personal details.

03

Individuals who believe there might be an error or discrepancy in their existing social security record and need to rectify it.

Fill

w 4v

: Try Risk Free

What is irs w 4v form?

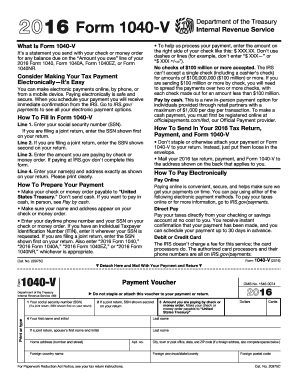

Instructions. Purpose of Form. If you receive any government payment shown below, you may use Form W-4V to ask the payer to withhold federal income tax. • Unemployment compensation (including Railroad Unemployment Insurance Act (RUIA) payments).

People Also Ask about form w 4v printable

How do I get less taxes taken out of my paycheck 2022?

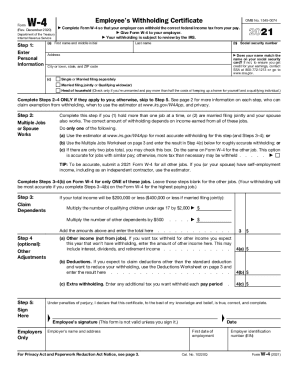

If it looks like your 2022 tax withholding is going to be too high or too low because of one of these or some other reason, you can submit a new Form W-4 (opens in new tab) now to increase or decrease your withholding for the rest of the year.

Can you submit form W 4V online?

Send form w 4v via email, link, or fax. You can also download it, export it or print it out. Type text, add images, blackout confidential details, add comments, highlights and more. Draw your signature, type it, upload its image, or use your mobile device as a signature pad.

Is there a new W 4V form for 2022?

The Updated Form W-4 Form W-4 had a complete makeover in 2020 and now has fewer lines to fill out. The way that you fill out Form W-4, the Employee's Withholding Certificate, determines how much tax your employer will withhold from your paycheck.

How much taxes should I have withheld from my Social Security check?

There are several ways to pay the taxes throughout the year and avoid an underpayment penalty or a big bill at tax time. You can file Form W-4V (opens in new tab) with the Social Security Administration requesting to have 7%, 10%, 12% or 22% of your monthly benefit withheld for taxes.

How do I send W 4V to social security?

You can download the form or call the IRS toll-free at 1-800-829-3676 and ask for Form W-4V, Voluntary Withholding Request. (If you are deaf or hard of hearing, call the IRS TTY number, 1-800-829-4059.) When you complete the form, you will need to select the percentage of your monthly benefit amount you want withheld.

Can form W 4V be filed online?

Send form w 4v via email, link, or fax. You can also download it, export it or print it out. Type text, add images, blackout confidential details, add comments, highlights and more. Draw your signature, type it, upload its image, or use your mobile device as a signature pad.

Is it better to claim 1 or 0 on your taxes?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

How long does it take to change withholding?

Employers must put an employee's new Form W-4 into effect no later than the start of the first payroll period ending on or after the 30th day after receipt of the revised Form W-4.

Can you change your tax withholdings at any time?

You can adjust your W-4 at any time during the year. Just remember, adjustments made later in the year will have less impact on your taxes for that year.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify social security withholding form without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including form w 4v voluntary withholding request. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Where do I find voluntary withholding request?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific w4v tax form and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit social security form w4v in Chrome?

w4 v form can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

What is can you change social?

Can you change social refers to the process or the requirements for modifying social security details or other associated information regarding an individual's social identity.

Who is required to file can you change social?

Individuals who need to update their social security information due to changes in personal details, such as name, marital status, or citizenship, are required to file can you change social.

How to fill out can you change social?

To fill out can you change social, individuals should complete the appropriate forms provided by the social security administration, providing required documents such as identification and proof of the required changes.

What is the purpose of can you change social?

The purpose of can you change social is to ensure that an individual's social security records accurately reflect their current personal information, which is crucial for efficient processing of benefits and services.

What information must be reported on can you change social?

Information that must be reported on can you change social includes personal identification details, new name or status changes, supporting documentation, and any relevant contact information.

Fill out your w 4v form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Printable w4v Form is not the form you're looking for?Search for another form here.

Keywords relevant to irs form w 4v voluntary withholding request

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.